To ensure a secure financial future in Canada, it’s essential to plan and consider various factors, particularly for retirement. The Registered Retirement Savings Plan (RRSP) is a vital resource to help you reach this financial goal. Whether you’re a beginner or seeking to enhance your existing RRSP strategy, this guide will equip you with the knowledge to navigate the realm of RRSPs confidently.

In this blog, we’ll break down the must-knows about RRSPs, including:

- What is an RRSP

- RRSP Contribution

- Limits and Deadlines

- Investment Options

- RRSP Withdrawals

What is an RRSP?

An RRSP, which stands for Registered Retirement Savings Plan, is a government-registered savings plan designed to help people achieve their goals when it comes to retirement savings.

The primary purpose of an RRSP is to encourage individuals to save for retirement by providing them with tax incentives. By contributing to an RRSP through many financial institutions, you gain the advantage of tax benefits. Investing in an RRSP offers a “tax-advantaged” status, which means that the money you contribute is not taxed in the year you make the investment.

Any investment earnings generated within the RRSP have the potential to grow without being taxed until you withdraw the funds.

RRSP Contribution

You can open an RRSP at any age without any specific minimum requirement. In most cases, the sooner you start, the better! There’s no such thing as starting too early when it comes to investing for retirement.

To qualify for opening and contributing to an RRSP, specific criteria must be met:

- Tax Residency: You need to be a resident of Canada for tax purposes.

- Earned Income: You must have income from sources like employment, self-employment, rental properties, and other eligible sources.

- Age Requirement: Contributions to an RRSP can be made until you reach the age of 71.

Adhering to this eligibility criteria ensures that you can open and make contributions to an RRSP in accordance with Canadian regulations (Avalon).

Limits and Deadlines

The Canada Revenue Agency (CRA) establishes yearly contribution limits for RRSPs. These limits depend on a percentage of your earned income in the previous year, with a maximum dollar amount. It’s important to note that exceeding the RRSP contribution limits can lead to tax penalties. It’s vital to track your contribution room and ensure you stay within the CRA’s set limits.

Your RRSP deduction limit is determined by the smaller amount between two factors (Government of Canada):

- 18% of your earned income from the previous year.

- The annual RRSP limit, which is $30,780 for the year 2023.

You have the flexibility to make contributions to your RRSP at any time during the year, including the first 60 days of the following year. Contributions made in January and February can be deducted from your income from the previous year. In past years, the deadline has generally been March 1st.

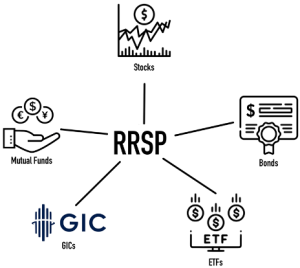

Investment Options

RRSPs offer a wide range of investment options to accommodate different risk tolerances and investment goals. Some common RRSP investment options include:

- Mutual Funds: Investment funds that gather money from multiple investors to create a diversified portfolio of stocks, bonds, or other assets.

- Stocks: Investing in individual company stocks allows you to own shares in a specific company. This option provides potential for growth but carries higher risk compared to other investment options.

- Bonds: Bonds are investments where individuals lend money to governments or corporations. In return, investors receive regular interest payments and get back the initial amount invested when the bond matures. Bonds are generally considered lower risk compared to stocks.

- Exchange-Traded Funds (ETFs): ETFs, similar to mutual funds, provide diversification by investing in a collection of assets. However, ETFs are traded on stock exchanges just like individual stocks.

- Guaranteed Investment Certificates (GICs): GICs are low-risk fixed-term investments offered by banks and financial institutions. They provide a guaranteed rate of return over a specified period.

RRSP Withdrawal

Withdrawing funds from an RRSP is a financial decision that should be considered carefully due to potential tax implications. When you withdraw money from your RRSP, it is treated as taxable income by 30%. Therefore, only 70% of the money that is withdrawn will be accessible. The amount withdrawn is added to your total income for the year and taxed at your marginal tax rate.

Additionally, it’s worth mentioning that there are certain circumstances where you can make withdrawals from an RRSP without incurring the usual tax penalties. For example, the Home Buyers’ Plan (HBP) and the Lifelong Learning Plan (LLP) allow you to withdraw funds from your RRSP for the purpose of purchasing a home or funding your education, respectively, under specific conditions. However, in these cases, there are repayment requirements to ensure the funds are eventually returned to the RRSP.

It’s crucial to consider the impact of withdrawals on your RRSP contribution room. When you withdraw funds from your RRSP, you do not regain the contribution room associated with that amount. The Canada Revenue Agency (CRA) only allows you to count a contribution once, meaning you cannot add back the amount of a withdrawal to your existing contribution room.

This has implications for your long-term retirement savings. By withdrawing funds from your RRSP, you reduce the potential for tax-free growth on those funds. Over time, this can have a significant impact on the overall development of your retirement savings.

It’s clear that understanding RRSPs is essential for anyone looking to secure a comfortable retirement in Canada. The Registered Retirement Savings Plan offers valuable tax advantages, flexible investment options, and the potential for long-term growth.

For further guidance and assistance in starting your RRSP journey, please don’t hesitate to reach out to us. Our team is here to provide you with personalized information, answer any questions, and help you navigate the process of opening and maximizing your RRSP. Contact us today to take the first step toward a secure retirement.