In Canada, a Tax Free Savings Account (TFSA) is a quintessential way to grow your savings and investments tax-free. If you are wondering how to use a TFSA, how to open a TFSA, or the benefits of these accounts, you certainly are not alone.

For the past decade, the Canadian government has been encouraging Canadian residents to take advantage of a new way to save money by creating the Tax-Free Savings Account (TFSA). While the accounts are straight-forward, they do have rules, regulations and quirks that are important to understand. Here are the most important things you need to know about TFSAs.

This guide will provide a concise summary of a TFSA and how it works.

What is a Tax-Free Savings Account?

Tax-Free Savings Accounts are available to Canadian residents aged 18 and older and who have a valid social insurance number (SIN). TFSAs were introduced in 2009 and were immediately available to anyone of age. It is a savings account that allows you to contribute to a wide range of qualified investments, where any investment income earned (such as capital gains, dividends, interest and other earnings) and any withdrawals made from the account aren’t subject to tax.

Qualified Canadians are allowed to contribute up to a specified amount each year to their TFSA. The maximum amount is adjusted by the government according to the consumer price index and rounded up to the nearest $500, as necessary. Unlike an RRSP, the contribution amount is not deductible on your income tax return.

Another important distinction with TFSAs is that you aren’t required to have earned income in order to contribute. While some people use TFSAs to supplement their retirement savings, the two accounts do not have the same income rules — RRSPs require the account holder to have earned income in order to contribute.

How does a Tax Free Savings Account work?

A TFSA allows you to put money into savings and investment which will grow tax-free. This includes interest, dividends, and capital gains. As a result, there is a yearly limit on contribution.

Note: Contributions into the account are after tax but growth within the account is tax-free.

Despite it’s name, Tax Free Savings Account, the account can be used for more than just cash savings. You can use it to invest in exchange traded funds (ETFs), guaranteed investment certificates (GICs), stocks, and more. The key part is that all these options can grow in your TFSA tax-free. At the end of the day, it’s a highly-effective tool for long term savings.

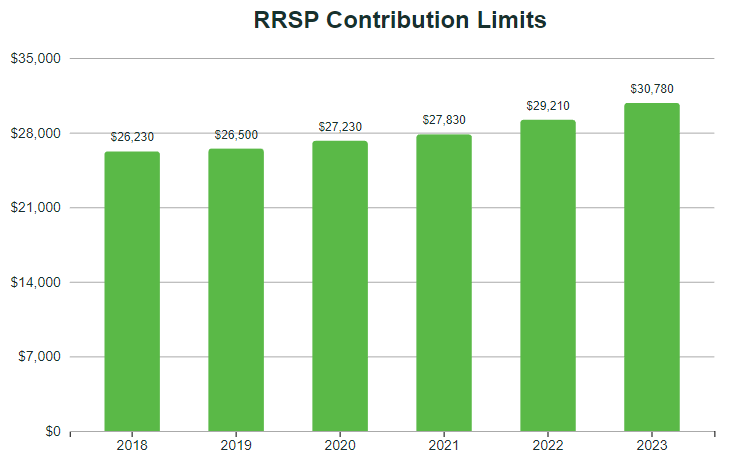

TFSA Contribution Limits

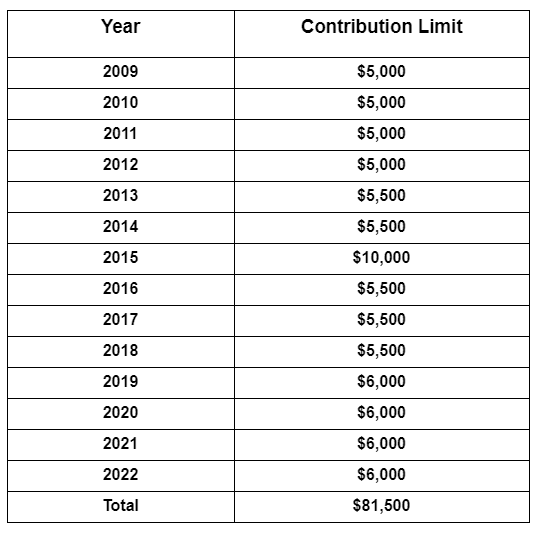

The Canadian government periodically reviews changes in the consumer price index and adjusts the maximum contribution limits Tax Free Savings Accounts as they deem it necessary. For 2019, they increased the annual contribution limit by $500, to a total of $6,000. It has remained there since.

The federal government announced that, starting in 2016, the annual TFSA limit would be fixed at $5,000, indexed to inflation for each year after 2009, but rounded to the nearest $500. That means once the cumulative indexed annual TFSA contribution limit hits $6,250, it will jump to $6,500. So when can you expect an increase?

For 2022, that indexed contribution amount is $6,162.70, based on a 2.4 % inflation factor, even though actual inflation was higher in 2021. The contribution limit is expected to increase to $6,500 in 2023, so long as the 2023 indexed inflation adjustment is at least 1.5%.

When you add all these numbers together, the total possible amount you would be able to contribute through 2022 (assuming you had never made contributions) is $81,500. Contribution room is the maximum amount that you can contribute to your TFSA. Earnings and growth in the TFSA do not count towards contribution room if they have not been withdrawn.

The following chart shows the contribution limits for each year that the TFSA has been available.

Major Benefits to Using TFSAs

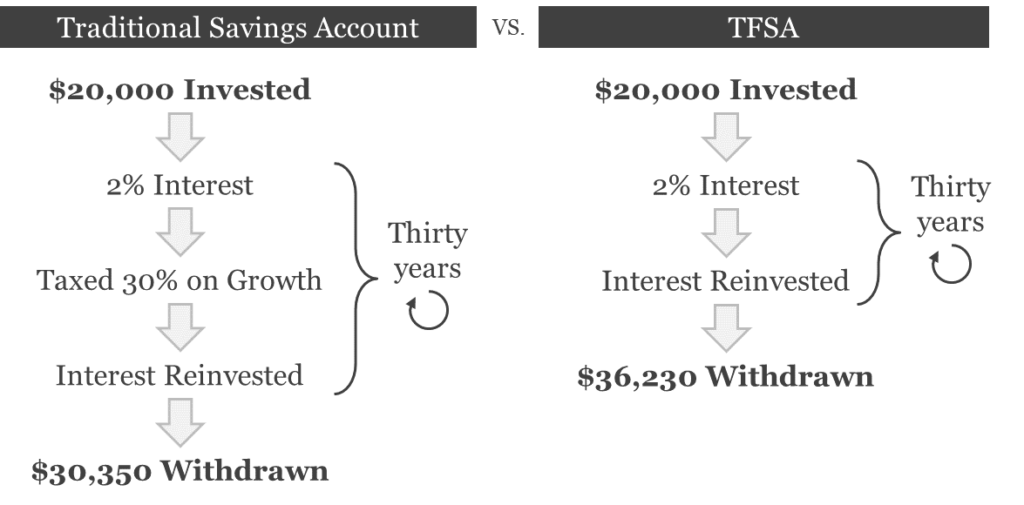

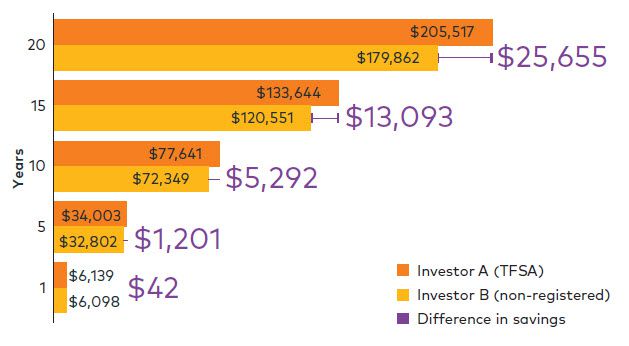

Obviously, one of the most exciting benefits to using TFSAs is the elimination of taxes on earnings and withdrawals. This helps you get more bang for your buck. For example, when you earn money on your investments, you don’t have to include it on your Canadian income tax return. It’s not taxable. When you take money out, you don’t have to pay tax.

Another major benefit to using TFSAs is that the withdrawals don’t count toward determining your government net income tested benefits, like Old Age Security, the medical expense benefit and the disability tax credit. This particularly benefits retirees, who are likely dependent in part on these benefits.

And finally, since TFSAs don’t require earned income, you can contribute to your account, even if you’re unemployed, staying home to raise a family or care for a family member, retired or living off of investment earnings.

How You Can Use TFSAs

The best thing about TFSAs is that there are no restrictions on what the funds invested in them can buy. They can be used for anything, such as:

- A New Car

- The Down Payment on a House

- Your Dream Vacation

- Retirement

- Home Renovations

- Opening a new Business, or Another Location for your Existing Business

- Savings for your Children’s Education

If you want to make a major purchase in the future (whether near or far), TFSAs can help you accomplish that goal. They’re designed to incentivize Canadians to save money, regardless of what that money is earmarked for.

You can even have more than one TFSA. So, if you wanted to have one designated for home improvement and another designated for your dream vacation, you could do so. However, you’re held to the same total contribution limits, regardless of how many accounts are in your name.

TFSA Rules, Regulations and Limits

You, the owner are the only person that can make contributions, determine how the money is invested and make withdrawals from your plan. You may give your spouse or common law partner money to invest in their TFSA. The earnings will not be attributed back to you. The total contribution amount cannot exceed the respective limits each of you has.

Calculating Contribution Room

The maximum amount that you can contribute to your TFSA is limited to your TFSA contribution room. If you make a withdrawal, then that withdrawal amount will be added to your available contribution room beginning Jan. 1st of the following calendar year.

The amount you may then recontribute includes any growth on the plan that you withdrew. For example; let’s say you contributed $6000 to a plan and the investment grew to $7,000. You withdrew $6500. The following calendar year, you could recontribute $6500 plus any more contribution room created the following year. And don’t forget any unused contribution room from previous years.

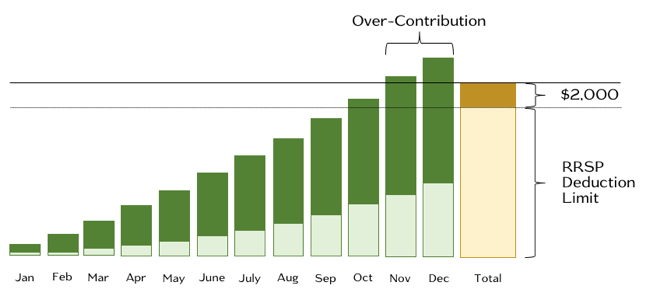

Over-contributions

If you contribute more than the total allowed amount to your TFSA at any point, you’ll be subject to a 1% tax on the highest excess amount in the month for each month you leave the excess amount in the account or until more contribution room becomes available that uses up the over contribution or until you withdraw the excess amount. That includes investment growth on the excess amount.

For example, let’s say you made your maximum contribution for 2021 ($6,000) in October, but chose to contribute another $250 in November, plus another $250 for December. Furthermore, the growth on the November contribution was $5 and another $5.50 in December. The excess contribution in December earned $4.50. You would have a total of $515 in excess contributions.

The penalty for November would be ($250 + $5 = $255) x 1% = $2.55.

The penalty for December would be ($255+$5.50 + $250+$4.5 = $515) x 1% = $5.15.

If you fail to reconcile this balance, you’ll continue to incur penalties until you are credited with extra contribution room or withdraw the excess amount. There is no $2000 grace amount like in an RRSP.

To prevent excess contribution penalties, it’s recommended that you track your contributions on your own. You can always check your official records according to the government, or request a paper statement to be sent to you, but keeping track of your own deposits can help clear up confusion. It’s your responsibility to make sure you don’t over-contribute.

One of the most helpful features of the TSFA is that you’re allowed to “catch up” on contributions you have not made within the overall limits of the plan. If you didn’t contribute the maximum amount in a given year, you’re allowed to do so in the future. There is no cap in terms of dates or age.

However, you cannot withdraw and re-contribute in the same year in excess of the yearly limit. For example; if you only contributed $5,000 in 2017 (when the maximum amount was $5,500), you could contribute an extra $500 throughout the course of 2018 without incurring any penalties. In this case, the extra $250 from November and December discussed in the example above would not be subject to the 1% tax.

Qualifying transfers from other TFSAs, exempt contributions, say from the plan of a deceased spouse or common law partner are not included in the amount of contribution room. The same holds true for transfers to a former spouse or common-law partner provided the transfer was made to satisfy the terms of a separation or divorce.

How Major Life Events Affect TFSAs

Major life events, such as death, divorce, or a move outside of Canada can affect your TFSA and have tax implications.

Death of an Account Holder

A holder living anywhere in Canada can designate a beneficiary on a Tax Free Savings Account investing in an insurance GIC or segregated fund. You can designate a beneficiary on a TFS account holding any other eligible investments if you live outside of Quebec.

In the case of a TFSA-holder’s death, you may wish to pass on your TFSA plan to your spouse or common-law partner if you have one. The survivor could be designated as the successor holder or as a beneficiary of the plan although you can also name a joint beneficiary where permitted by law. If you are unmarried, or not in a common-law partnership, you can choose to designate someone else, such as a former spouse or common-law partner, your child(ren), other family members, a friend or a qualified donee such as a registered charity. Keep in mind the restrictions for residents of Quebec.

If the spouse or common-law partner becomes the new account holder, (s)he can designate a new beneficiary or down the road, even a successor holder if that person gets remarried or enters into a common-law relationship and can then designate a new beneficiary, once again where permitted by law.

If you are in a legally-recognized relationship and your partner has been named as a, successor holder (called a subrogated policyholder in Quebec) and you have also named a beneficiary (where that is permitted under law), then the successor holder/subrogated policyholder designation will take precedence over a designated beneficiary. The survivor assumes the account on the date of death preserving the tax free treatment of growth in the plan.

The beneficiary, on the other hand, will receive the fair market value of the account on the date of the account holder’s tax-free death. Any gains earned in the account between the date of death and the transfer to the beneficiary will be subject to tax.

Divorce or Legal Separation

If a TFSA account holder gets divorced, or a common-law partnership is dissolved, a one-time direct transfer of funds is allowed from one person’s TFSA to the other person’s TFSA without affecting either individual’s contribution room. Transfer of funds must be completed by a financial institution.

In order for this transfer to be possible, two conditions must be met:

- The divorcing spouses or separating common-law partners must be living apart and independently at the time of the money transfer, and

- The transfer has been agreed upon or decreed by a court or written separation agreement in order to settle assets from your relationship.

Because this is a specially designated transfer of funds and not a withdrawal, this action does not create new contribution room for the individual who transferred funds out of their account to their ex-spouse or partner’s account.

Becoming a Non-Resident

If you choose to move out of Canada at any point, you can keep your TFSA and continue to collect earnings on your investments and make withdrawals without paying any tax on them in Canada. You may be subject to income tax on growth and withdrawals in your new place of residence outside of Canada.

A TFSA is not recognized as such in foreign countries. You must stop making contributions on the date you become an official non-resident. If you make contributions while you are a non- resident of Canada, you’ll be subject to a 1% in addition to other applicable taxes.

You’re considered a non-resident if you:

- Routinely live outside Canada as a matter of course, and you

- Do not have residential ties to Canada and you live in Canada fewer than 183 days out of a tax year. (Residential ties are considered owning a home or property in Canada, or having a spouse, common law partner or children still residing in the country).

It’s important to also remember that your TFSA contribution room does not accrue while you’re a non-resident of Canada. While you can make withdrawals tax-free (for Canadian income tax purposes only — this may be handled differently in your new country of residence), the contribution room created will not be available to you unless you re-establish residency in Canada.

Frequently Asked Questions (F.A.Q):

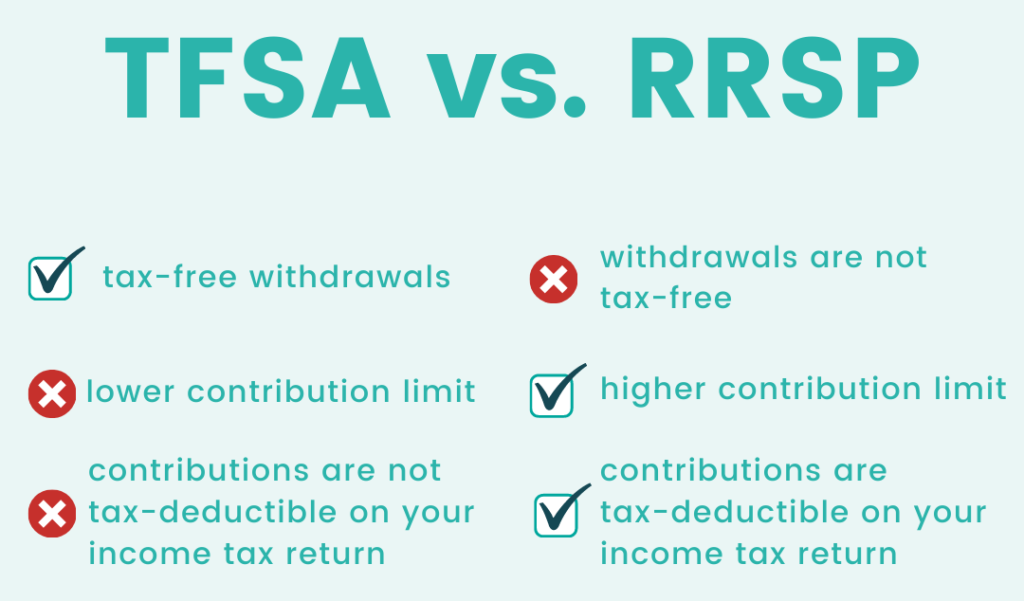

Which is better for tax purposes, an RRSP or a TFSA?

One of the questions that people struggle with is; “where do I put my long term savings and investments?” We are bombarded by the need to put money away for retirement and into a registered retirement savings plan, particularly during “RRSP season”, those first 60 days of the calendar year.

That’s when many Canadians gather some money to deposit into a registered retirement savings plan (RRSP) in order to get a tax break for the previous calendar year when they file their income tax returns a little while later. But is a registered retirement savings plan a better place to put your money than a tax free savings account (TFSA)? Let’s consider some important tax factors.

You need earned income to contribute to a registered retirement savings plan and not to a tax free savings account. The earnings on deposits on either plan grow tax-free while remaining in the plan. The income tax treatment of money coming out of either plan is a major consideration when deciding where to put the money at the outset.

If you think you will be in a lower tax bracket when you take money out of one of these plans, then having that money growing in a registered retirement savings plan may be the better option. The tax deduction you get from your deposits is bigger than the tax you will pay on your withdrawals. Remember that all of your deposits and the growth in your plan are taxable as ordinary income. All withdrawals are added to your net income which in turn determines your eligibility for most government benefits.

If you are in a higher tax bracket when you take money out of one of these plans, then having that money grow in a tax free savings account may be the preferred option. You don’t get a deduction for your deposits but all of your withdrawals are tax-free. None of your withdrawals are added to your net income calculations. They have no bearing on your eligibility for most of those same government benefits.

If you don’t expect your tax bracket to change when you take money out of either one of these plans, then there may not be a material tax advantage of one plan over the other. Keep in mind that withdrawals or an income flow coming from a registered retirement savings plan will add to your net income. There is no impact to net income or tax brackets when you withdraw or take an income from a tax free savings account. There are more considerations than just tax when deciding where to put limited savings.

Will CPP Enhancements Affect TFSAs?

Some have raised the question of whether the Canada Pension Plan (CPP) enhancements will change the way people use TFSAs in the future. It’s a valid question — if Canadians are receiving more in pension payments, would they need extra savings set aside for emergencies, or for everyday expenses?

Current CPP and QPP payments are aimed at replacing about one-quarter of a person’s income. CPP and QPP enhancements will eventually replace about one-third of the average person’s working income. With additional provisions factored into the final amount, the maximum amount a person can receive in 2021 is $1,203.75. This will increase by 2.7% in January 2022.

However, the average amount Canadians will receive in 2021 is much lower — $714.21. (You can check how much you could receive here for CPP. Check here for your statement of Participation in the Quebec Pension Plan.

In addition, CPP and QPP enhancements will be rolled out over a long period of time. The plan won’t be fully mature until 2065, so many living Canadians will never reap the full benefits.

And finally, CPP enhancements don’t apply to people who currently work, or worked at one time, in Quebec. QPP enhancements were launched on Jan. 1, 2019.

So while the CPP and QPP enhancements will help some people in retirement, TFSAs are still a helpful way to save for retirement — or for retirees to save extra cash when they’re able (since earned income isn’t a requirement for TFSAs).

Can you day trade in a TFSA?

Day trading refers to actively using an account (on a daily basis) for investing. While there are no set rules, the CRA states that these accounts are for long term savings and any daily trading can be subject to penalties.

Can a TFSA earn interest?

A TFSA can be opened as a savings account for earning interest or as an investing account to get a higher rate of return. This depends on your short-term and long-term financial goals.

If you are looking at a TFSA for earning interest, the first question on your mind is probably, “How do I get the highest possible interest rate?”.

While competitive interest rates are important, it is best to look at other factors too such as the ease of withdrawing money from your savings account or whether their is a local branch. For a summary of best rates across Canada, check out this updated comparison of best high interest Savings Accounts in Canada.

If you will be putting a sizable amount of money in a TFSA (or any other investment account), it’s always best to consult a financial expert.

Can you have more than one TFSA?

You can set up more than one TFSA account (for Investing, Savings, etc.). But even with multiple accounts, your contribution room remains the same. Multiple accounts does not mean more room. The funds within multiple accounts should not surpass your contribution limit. Surpassing it will result in a penalty.

How do you withdraw from a TFSA?

This depends on your provider. In most cases, you can withdraw money from the account anytime you want.

Note: If you max out your TFSA for the year and decide to withdraw money, you cannot re-deposit that amount within the same year (without penalty). That amount can only be added the following year when the contribution room opens up again.

Can I Transfer from an RRSP to a TFSA?

While specific details may depend on your provider, in most cases, you can make the transfer without penalty fees. It is important to note that you will pay taxes on the money withdrawn from the RRSP as though it were income for that year.

Is a Tax-Free Savings Account Worth Having?

As a resident of Canada it is a valuable investment tool. As a TFSA holder the investment you put into it grows tax free with no capital gains taxes. Though these contributions are not tax deductible, the benefits from the government are a great way to meet your savings goals no matter how large or small they may be. Make sure you know your contribution limits and work hard to meet your goal each year. We recommend that you speak with one of our experts before making decisions about how to invest your money.

Is a Tax-Free Savings Account Right For Me?

The answer to this question isn’t found in the back of the book. Tax-Free Savings Account (TFSA) is a deeply personal purchase and there are many factors to consider. In addition to taking into account your current family’s financial needs, you should also account for future expenses like tuition, funeral arrangements and any other debts you would like settled if you died.

Thankfully, AG Group Enterprise Inc, is here to help! Our mission at AG Group is to provide you with professional consultancy services for TFSA, RRSP, RESP, Life Insurance and more! With AG group’s insurance policies, you can protect the future of your family and your finances. A good policy ensures a bright future!