Certain permanent life insurance policies offer lifelong coverage and also bundle as an investment tool.

A part of each premium goes toward covering the cost of insuring your life, while the other part is routed to a built-in investment account, called cash value. The cash value earns interest and grows on a tax-deferred basis.

You can tap into your cash value any time you want and even withdraw it in full by canceling your policy. The amount you receive when you terminate a permanent life insurance plan is called the cash surrender value.

Continue reading to find out how it is calculated and whether cash value life insurance is right for you.

What is Cash Surrender Value?

Many permanent life insurance policies include a savings component, called the cash value. When you surrender such a policy, the insurance company pays you a certain amount of money, referred to as the cash surrender value. In this context, “surrender” means cancel, terminate, or return.

The insurer uses the following formula to determine how much money it owes you at the time of cancellation:

The cash surrender value = the cash value minus the surrender fee.

The surrender fee varies by the insurer, but it reduces gradually over the life of the policy. In the first few years, the surrender charge can be as high as 35% of the cash value. After ten or 15 years, it often whittles down to just 1% or is not applied at all.

There is one caveat to surrendering a life insurance policy – this value is taxable. However, you will not pay tax on the entire surrender value. Instead, you will get a tax bill only for the amount that exceeds the policy basis, since this amount reflects the interest or investment gains. The policy basis is the part you have paid in life insurance premiums.

What Types of Life Insurance Have Cash Value?

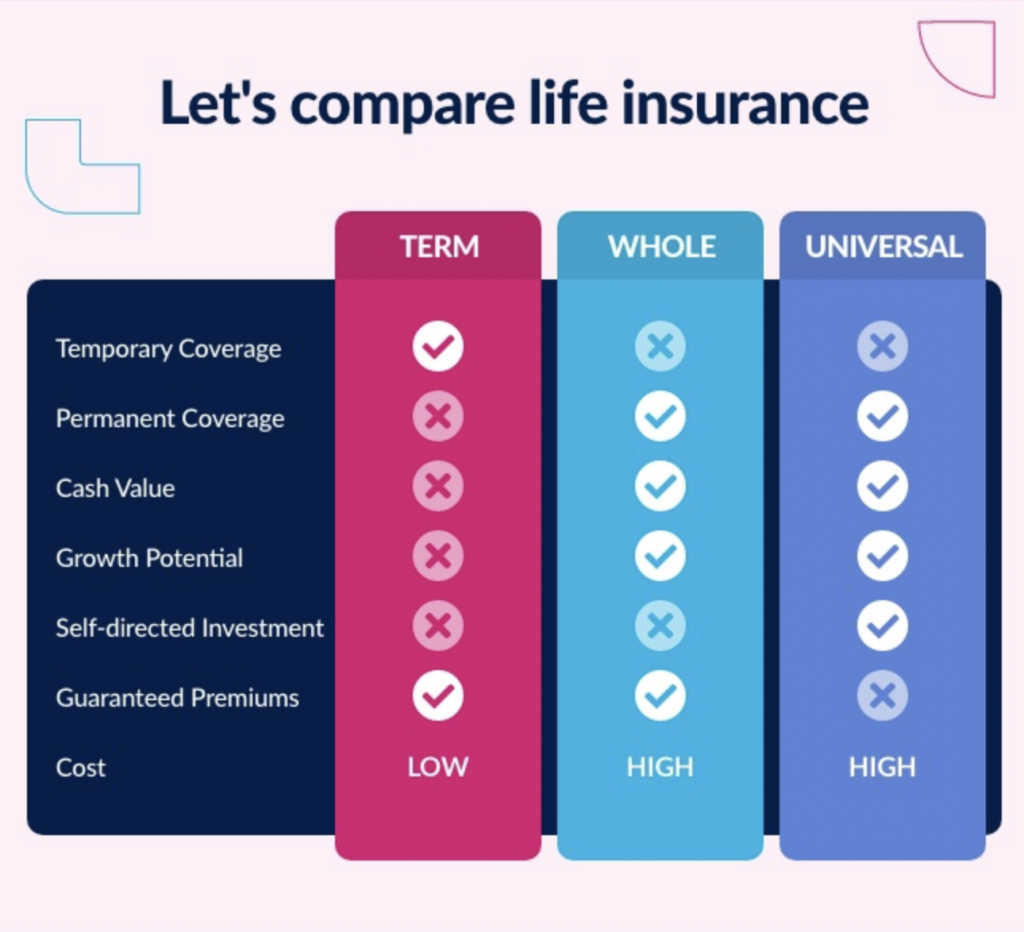

Life insurance products are either term or permanent. Term life insurance policies last for a specific period or until a specific age. The insurer pays out only if the insured passes on during the policy term. Term life plans do not build cash value.

Permanent life insurance lasts for your entire lifetime, as long as you make the premium payments. Permanent life insurance products are further divided into various sub-types, and only two of them — whole life and universal life — accumulate cash value.

Whole life insurance

Whole life insurance policies last as long as you do, have level premiums and promise guaranteed benefits. The cash value grows at a fixed rate determined by the insurance company, and you can use it for any purpose. For example, you can use it to pay the down payment on a house, pay for your child’s college tuition fees, or fund a new startup.

Universal life insurance

Universal life insurance plans are also permanent life insurance and accumulate cash value. However, they offer more flexibility with the premiums and death benefits.

There are three types of universal life insurance plans:

- Guaranteed universal life: These life insurance policies have little or no cash value and the premium payments and the death benefit are fixed.

- Indexed universal life: These life insurance policies may allow you to vary the premiums and death benefit, within predefined limits. The cash value is tied to a market index, so the rate of return is not fixed. If the stock market is having a good run, your cash value will grow at a faster rate. However, there is a maximum percentage you can gain, regardless of how well the market performs. And if the market drops, your cash value will grow at a minimum return rate, which can be as low as 0%. In other words, with an indexed universal policy, both your cash value’s upside and downside are capped.

- Variable universal life insurance: These policies allow you to vary the premiums and death benefit, within limits. The cash value is tied to sub-accounts selected by you, so you enjoy a certain level of control over how it grows. Smart investment choices can generate handsome returns on the cash value. But the cash value can also get wiped out completely if you make poor investment decisions. Variable universal life policies are more complex than other types of universal life plans and have higher fees.

Should I Buy Insurance With Cash Value?

Life insurance needs are rarely one-size-fits-all. Therefore, there is no definite “yes” or “no” answer to this question. Whether or not life insurance with cash value is right for you depends on your financial situation and long-term goals.

The most advantageous aspect of such a policy is that you get to accumulate wealth on a tax-deferred basis. Despite this, life insurance for cash value is not for everybody. Cash value life insurance offers a lower interest rate than traditional investment vehicles. Also, any unused cash value at the time of your death usually reverts to the insurer.

For most people, term life insurance is enough. It is cheaper and easier to understand. But if you have maxed out your retirement funds, have a sizable emergency fund, and can commit to a long-term contract, life insurance with cash value can be a good option. Even then, it would be best to speak to a trusted life insurance expert first.

Life insurance with cash value is complex and there are several types of policies available. The level of risk and potential for gains vary from one type to another, so it is important to understand what you are buying. An insurance agent or broker will walk you through all the options and help you choose a plan that perfectly matches your financial goals and risk tolerance.

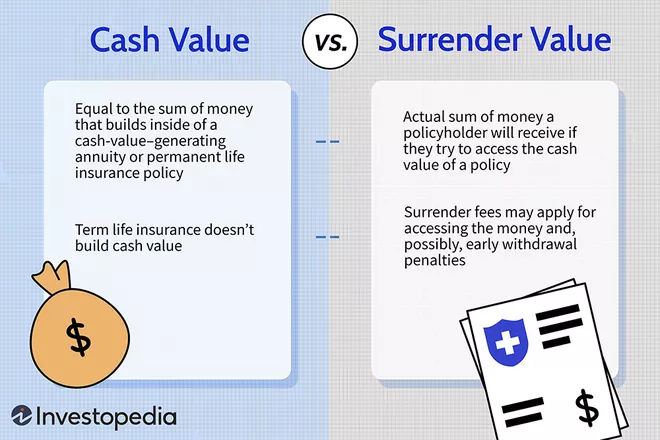

Cash Value vs Cash Surrender Value

Cash value refers to the sum of money that builds up in the investment component of a permanent life insurance policy. This money grows on a tax-deferred basis and can be tapped into any time you want. You can make a withdrawal or take a loan against your policy’s cash value for any purpose and use the funds however you like.

The cash value is for the policyholder to use during their lifetime. Upon the insured’s death, unused cash value generally reverts to the insurance carrier. The policy beneficiaries receive only the death benefit.

Cash surrender value, also known as policy surrender value, refers to the sum of money you receive when you surrender (cancel) your life insurance policy. Cash surrender value is equal to the cash value minus surrender fees.

If there is no surrender fee, which may happen after you have had the policy for a long time, the number is the same amount as the cash value. However, in most cases, the cash surrender value is less than the cash value.

How to Determine Cash Surrender Value

To determine the cash surrender value at any given time, you must find out two things: the actual cash value and the surrender charges. The cash surrender value is the difference between the two.

The surrender charges are pricier for new policies, but they become less expensive over time. During the first policy years, they can be as high as 35% of the cash value. Since cash value grows very slowly during the first few years before picking up the pace, you may receive little or no money if you surrender your policy soon after purchasing it.

For example, let us say you have a seven-year-old insurance plan that has a cash value of $50,000. You want to surrender it in return for its cash value and the surrender charge amounts to 10% of the cash value. This means you will receive $45,000. The insurance company will keep the remaining $5,000.

What is a Surrender Fee?

The surrender fee or the surrender charge is the cost you pay for canceling a permanent life insurance policy with cash value. The insurance company imposes this fee to recover its expenses in setting up the life insurance contract.

The surrender fee is a percentage of the accumulated cash value and varies depending on the age of the policy. When you cancel a policy, the insurer takes out the surrender fee from the cash value and you receive the remaining amount.

How to Access Cash Value without Surrendering Your Policy

Surrendering your life insurance policy is not the only way to access its cash value. You can also access it by any of the following ways:

Taking a policy loan

If your policy has cash value, you can take a loan against it. The insurance carrier will not run a credit check, nor will it ask you why you need the loan. That is because you are basically borrowing money that is yours.

You do not even have to pay back the loan — but that does not mean it is a gift. The insurer will deduct the loan amount, plus interest, from the payout it issues to your beneficiary when you pass on. If you have a dependent, consider paying the interest at least. Otherwise, your death benefit might become significantly reduced or completely wiped out.

Before taking a policy loan, keep in mind that the loan amount is not taxable only if the policy is active. If the coverage lapses because of non-payment, you can receive a tax bill. You will not have to pay tax on the entire loan amount. Only the part of the loan that exceeds your premium payments (the policy basis) is considered taxable income.

Making a withdrawal

You can withdraw cash value partially or in full anytime you want. However, a withdrawal can reduce the death benefit significantly or even completely. As such, it might be a good option only

if your life insurance needs have reduced; otherwise, your beneficiaries may receive little or no payout.

As is the case with a policy loan, any withdrawal above the policy basis is taxable.

Using the cash value to pay premiums

Once you have amassed enough cash value, you can use it to cover future premiums. If you are currently struggling to pay premiums, this option can make it easier to keep your policy in force. However, keep an eye on your policy’s cash value level, because if you exhaust all of it, your policy could lapse.

Increasing the death benefit

Another way to tap into the cash value is by using it to increase the death benefit amount. This way you can ensure your hard-earned money does not go into your insurer’s pocket after your death.

Selling your life insurance policy

If your policy has sufficient cash value and you no longer need coverage, you may consider selling it to a third party. In return, you will receive a one-time cash payment, which is likely to be more than the cash value but less than the death benefit. The new policyholder will pay all the future premiums and receive the death benefit upon your death.

As is the case with surrender, you will be taxed for the amount that exceeds the policy basis.

Nevertheless, you should end up with more than the cash surrender value. However, the process of selling a life insurance policy — known as life settlement — can be time-consuming and finding an interested buyer can be difficult.

Conclusion

The cash surrender value is the amount of money the insurer pays when you decide to terminate a whole life or universal life policy. It equals the policy’s cash value minus surrender charges. The surrender charges are expensive during the first few policy years, but they reduce over time.

Which is the Best Life Insurance Policy?

The answer to this question isn’t found in the back of the book. Life insurance is a deeply personal purchase and there are many factors to consider. In addition to taking into account your current family’s financial needs, you should also account for future expenses like tuition, funeral arrangements, estate taxes, and any other debts you would like settled if you died. (If that sounds complicated, there are insurance calculators).

When you search for insurance quotes, there are a multitude of options to choose from. Nevertheless, you should only purchase a policy you can afford and that makes sense for you and your family.

Thankfully, AG Group Enterprise Ltd, is here to help! Our mission at AG Group is to provide a wide range of life insurance policies, including term coverage, permanent coverage, RRSPs, RESPs, and more!

With AG group’s insurance policies, you can protect the future of your family and your finances. A good policy ensures a bright future!