Considering a Life Insurance plan can remarkably secure the financial future of yourself as well as your loved ones. Although it may seem daunting and puzzling to find the right fit for you, life insurance is a safeguarding tool that protects your family from unexpected drawbacks that may occur in the future. Permanent life insurance, in particular, offers a compelling solution, ensuring lifelong protection and leaving a lasting positive impact on your family for generations to come

In this blog, we will provide insight and simplify the world of permanent life insurance by addressing:

- What is Permanent Life Insurance and what are its benefits?

- What is the difference between Term Life Insurance and Permanent Life Insurance?

- Types of Permanent Life Insurance

- Key Considerations for Obtaining Permanent Life Insurance

What is Permanent Life Insurance?

According to Sunlife, “Permanent Life Insurance is an insurance policy that allows you to have lifelong coverage without expiration.” Permanent Life Insurance premiums can be paid on a monthly or yearly basis and differ from person to person depending on a range of factors. Money from this policy may be withdrawn throughout your life, which is taxed, or may be taken out by a beneficiary when you pass away through tax-free payments.

There are many beneficial factors and advantages that come with permanent life insurance including:

- Lifelong Coverage: Permanent Life Insurance offers coverage that never expires, ensuring protection throughout your entire life.

- Tax-Free Death Advantage: Upon your passing, your beneficiary can receive the money from your policy as a tax-free death benefit. This amount can be utilized at their discretion, whether it’s for paying off debts, mortgages, covering essential living expenses, funding education, funeral costs, or any other purpose they deem necessary.

- Cash Value Option: Many policies offer a cash value option that allows you to accumulate and save money during your lifetime. This cash value can be used for various purposes, such as taking loans, covering investments, paying premiums, or providing retirement income. However, it’s essential to keep in mind that withdrawing cash values might reduce the overall death benefit of the policy.

While Permanent Life Insurance offers several beneficial features, it also comes with certain drawbacks to consider. Permanent life insurance policies can be more complex than term policies, with various investment and savings components. Understanding these complexities might require financial expertise, and policyholders could find it challenging to grasp all the details. Furthermore, premiums can be quite high, making it challenging for some individuals to keep up with the payments. Additionally, If you’re unable to keep up with premium payments, your permanent life insurance policy could lapse, causing you to lose both the insurance coverage and the accumulated cash value.

What is the Difference Between Term and Permanent Life Insurance?

Life Insurance can be broadly categorized into two main types: Term Life Insurance and Permanent Life Insurance—the critical distinction between the two lies in their premium structure and coverage duration.

Term Life Insurance offers coverage for a specific period, such as 10, 20, or 30 years. During this term, the premiums are generally more affordable compared to Permanent Life Insurance. If you pass away within the specified term, your beneficiaries will receive the death benefit.

However, once the term ends, the coverage also terminates, and no further premiums need to be paid. At this point, the family will no longer be eligible to collect a death benefit in case of your death.

If desired, you have the option to add more terms to your policy once the initial term expires, extending your coverage for additional periods. This flexibility makes term life insurance an attractive choice for those seeking temporary coverage with lower premiums during specific phases of life.

Below is a comparison between usual Term and Permanent Life Insurance policies.*

| Term Life Insurance | Permanent Life Insurance | |

| Coverage | Often varies

Options available for 10, 20, 30, and up to 40-year terms

Options available to extend and renew terms |

Fixed for life |

| Premium Rates | Often more affordable | Often more expensive |

| Tax-Free Benefits | If the term is expired and not renewed at the time of death, beneficiaries do not receive a tax benefit

If the term is renewed at the time of death, the beneficiary with receive a tax-free benefit |

After death, your primary beneficiary receives a tax-free benefit payment. |

| Cash Value | No | Yes |

*Coverage, premium rates, tax-free benefits, and cash value policies can vary among different insurance companies and their specific policies. It is essential to refer to your insurance company’s life insurance policies to understand the exact terms and conditions applicable to your plan.

Types of Permanent Life Insurance

Most insurance companies typically offer three primary types of Permanent Life Insurance plans: whole life insurance, universal life insurance, and participating life insurance. Additionally, some insurance providers may offer a broader range of plans tailored to meet your unique needs and preferences. It’s essential to explore the options available and select a plan that aligns with your specific financial goals and circumstances. “Finding the right permanent Life Insurance policy.

“Life Insurance isn’t just a policy; it’s a promise of protection and peace of mind for your loved ones. It ensures that your family’s dreams continue even in your absence. With every premium paid, you’re investing in the future, and with every moment lived, you’re securing a lifetime of love and care”

– Chief Compliance Officer at AG Group.

Whole Life Insurance

Whole Life Insurance offers the benefit of providing your beneficiaries with a tax-free death benefit upon your passing, which depends on the coverage amount you choose and the premiums you pay during your lifetime.

Unlike Term Life Insurance, there is no time limit or expiration with whole-life coverage; it remains active throughout your entire life as long as you continue to pay the premiums.

Additionally, Whole Life Insurance policies accumulate a cash value over time, which you can access and utilize during your life. This cash value benefit provides a level of financial flexibility and can be used for various purposes, such as borrowing against it or withdrawing funds as needed.

Universal Life Insurance

Universal Life Insurance offers greater flexibility compared to Whole Life Insurance. With Universal Life Insurance, you have the option to adjust your premiums and death benefits according to your changing financial needs and circumstances.

Similar to Whole Life Insurance, Universal Life Insurance also provides a tax-free death benefit to your beneficiaries upon your passing.

Additionally, Universal Life Insurance policies continue to accumulate a cash value, providing you with potential financial benefits and options during your lifetime. You can access this cash value for various purposes, adding an extra layer of financial security and adaptability.

Participating Life Insurance

Though lesser known, Participating Life Insurance ensures your beneficiaries’ financial security by providing them with a death benefit upon your passing.

During your lifetime, Participating Life Insurance policies have the potential to earn dividends and participate in investments. These dividends can be used to reduce your premiums, making it a valuable feature that may contribute to lower overall costs and enhanced policy benefits.

**Important Note: For a comprehensive understanding of Permanent Life Insurance options and to find the best-fit policy for your specific situation, it is essential to consult your insurance provider and carefully review your policy details. Their expert guidance will help you make informed decisions tailored to your unique financial needs and objectives.**

Key Considerations for Obtaining Permanent Life Insurance

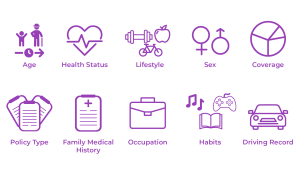

Common factors used by insurance companies to determine your premium include but are not limited to:

- Age: Younger individuals typically receive lower premiums since they are considered to be at a lower risk of mortality.

- Health Status: Your overall health and any pre-existing medical conditions can significantly impact your premium. A medical exam is often required by most insurance companies.

- Lifestyle Habits: Factors like smoking, alcohol consumption, and risky activities may lead to higher premiums.

- Sex: Historically, women have been associated with longer life expectancy, resulting in lower premiums compared to men.

- Coverage Amount: The higher the coverage amount you choose, the higher the premium is likely to be.

- Policy Type: The type of life insurance policy you select (term, whole life, universal life, etc.) can influence your premium.

- Family Medical History: Certain hereditary medical conditions in your family may influence your premium.

- Occupation: Certain professions may be considered riskier, leading to higher premiums.

- Lifestyle and Hobbies: Engaging in dangerous activities or hobbies may increase your premium.

- Driving Record: A poor driving history may impact your premium, especially in policies that include an accidental death benefit.

***It’s important to note that the weight of these factors can vary among different insurance companies, and they may use their unique underwriting guidelines to determine individual premiums. It is best to compare quotes from multiple insurers and seek guidance from an insurance professional to find the most suitable and affordable policy for your needs.***

In conclusion, Permanent Life Insurance stands as a valuable financial tool that offers lifelong coverage and a host of benefits to policyholders and their beneficiaries.

Unlike Term Life Insurance, which provides coverage for a specific period, Permanent Life Insurance remains in force throughout the policyholder’s lifetime, ensuring a tax-free death benefit to loved ones upon the policyholder’s passing. Its flexibility allows for cash value accumulation, enabling policyholders to access funds for various financial needs during their lifetime.

The key benefits of Permanent Life Insurance include the peace of mind it provides, the opportunity to build wealth, and the lifelong protection it offers. Various factors impact premium rates and understanding these factors and how they affect premium calculations is crucial in selecting a permanent life insurance policy.

Consulting with one of AG Group’s insurance professionals and exploring policy options can help individuals find the best-fit Permanent Life Insurance plan tailored to their specific needs and aspirations. We offer free consultations to those interested in talking about their unique circumstances.