Have you considered term life insurance? You’ve probably reached a major life milestone: new baby, new house, new business.

Because your responsibilities have grown, you need financial protection to back them up.

At this point, you’re probably wondering where and how much term life insurance costs in Canada. However, the most important question is: who offers the best rates?

We’ll discuss how to choose the right term length and coverage amount for you, as well as what to expect in terms of premiums.

You will also learn how to choose the right term life insurance provider in Canada.

What is term life insurance in Canada?

Term life insurance provides coverage for a set period of time, such as 10, 20, or 30 years.

In order to keep your term life insurance active, you have to pay a monthly fee known as a premium.

If you purchase term life insurance in Canada, you choose the term length and amount of coverage you want based on your needs.

Upon your death, your insurer will pay the beneficiary of your life insurance policy an amount equal to your coverage.

Suppose you purchase a $1,000,000 life insurance policy for 20 years. Your husband is named as the beneficiary. The life insurance company will pay $1,000,000 to your husband if you die before the end of those 20 years.

The payment is known as a death benefit. Your beneficiaries will receive your death benefit in the form of a tax-free lump sum.

This money can be used in many different ways: to pay for your children’s college tuition, to pay your mortgage, to buy groceries, etc.

Your monthly premiums and coverage amount will be locked in for the entire term of your policy, no matter how long it lasts.

In other words, your health status will not affect how much you pay per month during your term. Now that’s a relief.

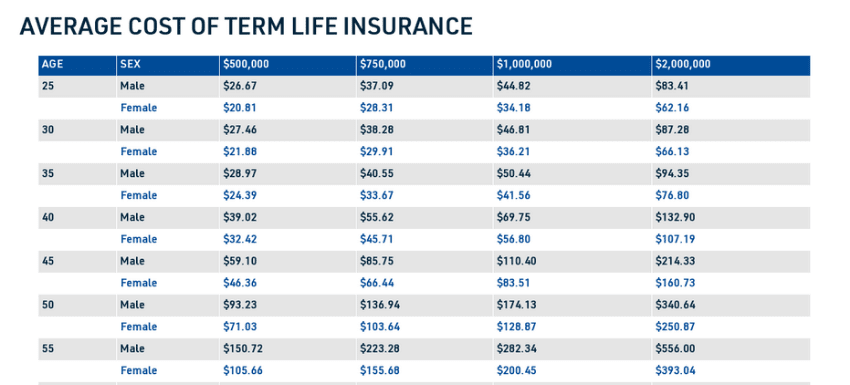

How much does term life insurance cost in Canada?

The cost of a term life insurance policy in Canada depends on:

- Your age

- Your biological sex/gender identity

- Whether you smoke

- Your health status

Your base rate is determined by the first three factors. Depending on your health status, your base rate may increase. If you have diabetes, for instance, your monthly premiums will likely increase.

Let’s look at some sample rates.

Term life insurance rates: man, non-smoker

How term life insurance rates are calculated in Canada

Let’s dive into how term life insurance rates differ based on your options.

- The coverage amount you choose

If you pass away during your term, the coverage amount is what you want your beneficiaries to receive.

The beneficiaries of a $1,000,000 policy would receive $1,000,000 tax-free if the unthinkable happened.

Your beneficiaries will receive more if you pass away during your term if you choose more coverage.

There is a catch, though: if you want your insurer to pay out a larger death benefit, you must pay higher premiums every month.

The cost of coverage for $250,000 is about $24.77 a month, whereas coverage for $500,000 is about $39.63 a month.

- The policy length you choose

You’ll pay more if you buy a policy at age 20 and want coverage for 30 years, rather than purchasing coverage for just 10 years, i.e. until you’re 30.

You’re more likely to die between the ages of 20 and 50 than between 20 and 30. Statistically, that’s just the cold hard reality.

Therefore, if you extend your coverage into your later years, you’ll pay more every month.

An insurance policy for $250,000 for 20 years would cost $24.77 a month, while an insurance policy for $250,000 for 30 years would cost $41.02.

- Your personal characteristics

The question isn’t whether you enjoy craft beer, or whether you speak three languages, or whether you have a terrible sense of direction.

We are talking about how risky you are to insure.

The question is whether anything increases your risk of dying while holding your policy.

The following are factors that may affect your interest rate:

- Age: Your premiums increase as you age. It is more likely that you will die during a 20-year term if you buy a policy at the age of 40 than if you buy the same policy at the age of 20.

- Gender: Men pay higher premiums since, statistically, they tend to die younger than women.

- Health: If you have a pre-existing condition that increases your risk of dying early, you’ll pay higher premiums. This could include diabetes or a heart condition. Or perhaps you have a family history of illness.

- Risky hobbies: Anything that increases your chance of accidental death, like frequent skydiving.

- Smoking Status: In general, smokers are more likely to die earlier than non-smokers, so they are charged higher premiums.

If you were 35 years old and a healthy non-smoker, a $250,000 20-year term policy would cost you $24.77 a month. When you purchase the same policy at age 45, it will cost $55.20 a month.

Who’s eligible for term life insurance in Canada?

For term life insurance policies, age is the most important factor to consider.

For term life insurance in Canada, you need to be between the ages of 18 and 65.

To be eligible for any term life insurance policy in Canada, you must be at least 18 years old.

Second, most life insurance companies sell term policies only to Canadians under 65 years of age.

Some insurers offer term insurance up to age 75, with term coverage extending as far as age 85. Meaning, if you’re 75 years old you can still buy a 10 year term life insurance policy.

What about pre-existing health conditions?

It is possible to qualify for term life insurance policies without undergoing a medical exam.

However, you’ll probably have to pay much higher premiums. In addition, you will be asked medical questions. Usually, this option is referred to as “no medical life insurance” or “simplified life insurance.”

You should apply for a traditional policy first. You should still have the medical exam even if you have been flagged as high risk. You may still qualify for lower rates and higher coverage than with simplified life insurance.

Also, the cost of medical exams in Canada is covered by the insurer. If you are not covered, you do not need to pay for the exam.

Why is term life insurance popular in Canada?

Term life insurance is becoming increasingly popular in Canada since it provides financial security during the years when you will need it most.

A recent survey found that 33% of Canadian parents with children under 18 own term life insurance and 25% own mortgage life insurance.

Usually, you need term life insurance if:

- You have young kids who depend on you financially

- A mortgage that would be hard for your family to pay without your income

- You take out a large loan to start a new business, for renovations to your home etc.

Good to know: Term life insurance is different from permanent life insurance, which doesn’t expire. It’s very expensive and best for wealthy Canadians with complicated financial situations.

When they start having children or buy their first house, many Canadians choose to purchase term life insurance. Which are two life experiences that a large number of Canadians go through!

Can I really afford to add life insurance to my list of expenses?

When you’ve just added a mortgage payment or a diaper subscription to your monthly expenses, buying life insurance may seem overwhelming at first.

Term life insurance, on the other hand, is the cheapest sort of insurance on the market because it only covers you for a set amount of time.

Even if you’re young and still trying to establish yourself in your career, it’s quite affordable at $20 to $40 per month.

What term life insurance coverage is right for you?

When you buy term life insurance, you’ll want to choose a term length and coverage amount based on:

- The amount of financial protection your family needs

- The length of time they need it for

For many people, this ends up being the same as their monthly spending until their children have left home and their mortgage has been paid off.

However, based on your family’s circumstances and preferences, your needs may differ from those of others. If you want to cover your children’s post-secondary education, for example, you’ll need a lengthier policy term.

It’s also vital to think of potential expenses that aren’t currently a factor while determining your coverage amount.

Real-life example: term life insurance in Canada

Annie is a stay-at-home mom of twin boys and is expecting another baby.

During the day, her partner is at work.

Annie is very busy doing the eight million things that stay-at-home moms do every day, from preparing dinner to wiping butts to calming tantrums about “too wet” bath water.

If she died when her children were still young, her partner may be forced to pay for childcare so that they can continue working.

Annie’s family live in Calgary. The average cost of daycare is $1,075 per child. That’s more than $3,000 for three children! For most families, an extra $3,000 per month is a big expense.

When purchasing life insurance, it is critical to factor in these types of expenses to ensure that your family will have the finances they require if the unimaginable occurs.

What’s the best term life insurance in Canada?

Are you looking for the most affordable term life insurance in Canada? When comparing different Canadian insurers, keep the following considerations in mind.

1. How trustworthy is the insurer?

Purchasing life insurance, like marriage, is a long-term commitment. Even if you don’t die until 90 % of the way through a 30-year term policy, you want to know that your insurer will be around to pay you your death benefit.

That’s why you should go with an insurer that has the financial stability to last the test of time.

The good news is that life insurance in Canada is highly regulated. This means that practically every life insurance firm in Canada is in good financial shape.

Furthermore, government regulations require all Canadian life insurance businesses to be members of Assuris. If the insurer fails, Assuris will ensure that you receive 85 percent of the benefits you were promised.

2. What coverage options are there? What are the exceptions or exclusions for payout?

Term life insurance policies from different Canadian insurers will have different features.

To ensure you acquire the best policy, seek one with extensive coverage (above $100,000), few exceptions or exclusions, and the ability to renew your policy later.

The majority of insurers provide coverage ranging from $100,000 to $5,000,000. Suicide within the first two years of the insurance is the only exclusion. Within the first five years, you can extend your coverage at any time.

3. Do they accept electronic applications?

Online life insurance applications are not only easier to complete, but they are also processed faster.

Filling out a paper application can actually lengthen the time it takes to process your application by six to eight weeks. That is simply frustrating.

The moral of the story is that if you want a smoother, speedier application procedure, opt for an insurer that offers online applications.

4. Are they competitive on price?

In Canada, it’s usual to find a broad variation of costs for the same term insurance coverage from different insurers.

Thankfully, a cheaper price does not imply that the policy is a rip-off or that it is of lesser quality.

A lower price usually indicates that the provider is pricing the coverage more aggressively in order to earn your attention.

There’s no reason to pay more than you need to for a term life insurance policy, regardless of what some insurers might claim.

Which is the best term life insurance policy for me?

The answer to this question isn’t found in the back of the book. Life insurance is a deeply personal purchase and there are many factors to consider. In addition to taking into account your current family’s financial needs, you should also account for future expenses like tuition, funeral arrangements, estate taxes, and any other debts you would like settled if you died. (If that sounds complicated, there are insurance calculators). When you search for insurance quotes, there are a multitude of options to choose from. Nevertheless, you should only purchase a policy you can afford and that makes sense for you and your family.

Thankfully, AG Group Enterprise Ltd, is here to help! Our mission at AG Group is to provide a wide range of life insurance policies, including term coverage, permanent coverage, RRSPs, RESPs, and more!

With AG group’s insurance policies, you can protect the future of your family and your finances. A good policy ensures a bright future!