It’s not common knowledge what a ‘term life insurance‘, a ‘permanent life insurance’, a ‘death benefit’ means. We understand how complicated insurance can seem, so we’re here to help you figure out how insurance works in Canada, how much it costs, and whether you need a policy.

What is life insurance – for a lot of us – is not exactly an area of expertise. Whenever the topic of insurance comes up, we usually just nod and hope we won’t get asked about how it works, what kind of insurance I need, how much it is, and more. This is an overview of the different types of insurance policies available in Canada, their costs, and who should consider getting one

About one-third of Canadians are currently without insurance and 1 in 4 millennials in the country admit they are unlikely to purchase any kind of insurance in the near future.

In most cases, we don’t know much about insurance. In Canada, insurance 101 isn’t common knowledge, which is precisely why it’s a subject worth exploring, especially if you’ve become more and more close to real estate agents, in-laws, or new babies.

Where do we begin? Does it count as a charity concert? What does “participating insurance” entail? Is “return-of-the-premium” a new Star Wars film?

Let’s begin with some basics…

What is life insurance?

A life insurance plan is an agreement between you and an insurance company, under which if you die, they will pay out a death benefit: a lump sum of tax-free money to an individual of your choosing. In return, you agree to pay them an insurance premium periodically: a small amount over time.

Both parties decide on the amount of cash coming in and out as well as the timeframes involved, but in a very simplified form, that’s it.

What can an insurance claim payment be used for?

Your beneficiary (the one you select to receive the payment) may decide what to do with the death insurance death benefit.

It is common for people to use the lump-sum payment given by an insurer to cover their family’s ongoing financial needs (such as housing, tuition, personal bills, etc. ), pay off their mortgage, credit card debt, and business loans, as well as complete their funeral plans. Death benefits are tax-free.

Alternatively, if you do not have a family, you can designate an institution (such as your college or a charity) as the beneficiary of your policy so that your death benefit is given to them as a tax-free gift. If you don’t name a beneficiary, the death benefit is paid to your estate and may be taxed.

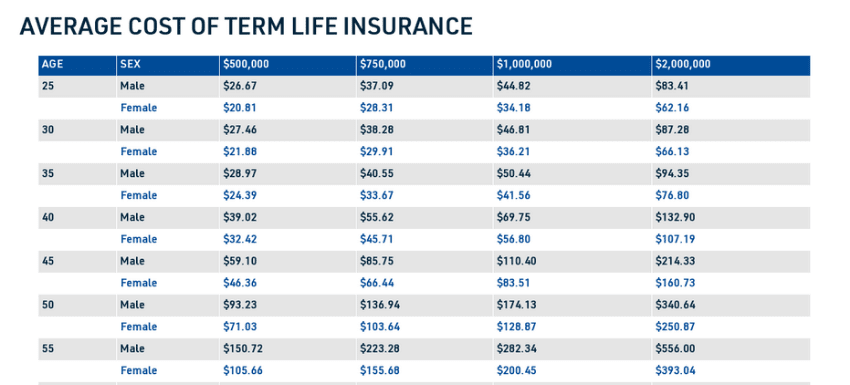

What is the average cost of insurance?

There are several factors that influence the cost of insurance. For most young, healthy adults, the cost of a 20-year term life insurance policy in Canada is quite reasonable. Most millennials estimate the actual cost of insurance to be up to five times greater than their actual cost. Prices can be as low as the cost of an extra-large pizza.

In the case of a 30-year-old non-smoker from Ontario in average health, a $500,000 death benefit would cost $24 a month on a 20-year plan. If she reduces her death benefit, the cost of 20-year term life insurance will be even lower. You can and should be able to afford insurance if you customize your policy to meet your specific needs and budget.

Do I need insurance?

Maybe a better question is, do the people in your life need it?

The money is for clearing your personal or business loans, and it is meant to replace the income you would have provided if you had been alive.

You can secure assets for your family’s future by investing in an alternate income source when you buy insurance. In the absence of insurance and the security of this death benefit, your family’s financial future is dependent on one person — you, who is still alive and earning an income.

As you and your salary disappear, all the things you want for your family, like a mortgage-free house or free college tuition, as well as their current needs, like food, clothes, and even a Netflix subscription, may be compromised. Diversifying your income-producing investments to include insurance will allow your family to enjoy the great things (education, financial freedom, on-demand entertainment).

Therefore, even though we aren’t going to tell anyone they need insurance, unless they’re young, wealthy, debt-free, single and childless (and planning on staying single for quite some time), we can tell you that you might want it.

After all, insurance isn’t something you buy for yourself. It’s for the people that depend on you.

How much insurance do I need?

You should get as much life insurance that you need, that you can afford. While most of us would like to leave a multimillion-dollar fortune to our families at death, that’s not realistic for most of us.

Regular coverage fees are required for the duration of your term, which can last decades or even the rest of your life. An insurance policy worth $1 million is worthless if your payments are missed and you lose it.

The best way to determine what affordable means to you is to build a budget that takes into consideration your family’s current financial needs, their future needs, your current liabilities and debts, and any costs associated with your death.

That’ll reveal what kind of coverage amount you should aim for and the costs associated with it. We highly recommend using an insurance cost calculator to get a quick but comprehensive recommendation. With the insurance calculator, you can calculate a personalized coverage amount that meets your individual requirements.

What are the different types of life insurance in Canada?

There are two main types of insurance: term life insurance and permanent life insurance (or whole life insurance). Term life insurance has both pros and cons, but the majority of Canadians (76 percent) wind up with it, whether through individual plans or as a group plan through their employer.

What is term life insurance?

Term life insurance is a simple insurance product that guarantees to pay out if you die within a given period of time, or ‘term’.

In contrast with whole life insurance, permanent life insurance, and universal insurance, term life insurance is typically purchased at a ten-year interval. You can choose a smaller term length or if you prefer, you can choose to have your insurance cover you until you reach specific age milestones like senior-citizen status at 65.

Why do I need term life insurance? Is it worth it?

Term life insurance provides temporary coverage because it’s designed for temporary needs.

Most people take advantage of this when their children are young, their mortgage is new, or they are at the height of their earning potential. However, this state of vulnerability lasts only a couple of decades. Afterwards, your children are self-sufficient, your mortgage is almost paid off, and you’re planning for retirement.

In addition to providing flexibility in your financial planning, term life insurance allows you to buy only the coverage you need to manage specific life risks at a manageable price. A term life insurance policy in Canada has no value over time and cannot be invested or surrendered for cash. This makes payments for premiums lower.

What are premiums?

A life insurance premium is the amount of money you agree to pay the insurance company, usually monthly (although you can choose different payment frequencies). Your premiums will be higher if you are older, live a longer term, or have a larger death benefit.

Conversely, if you’re a healthy young person who hasn’t smoked (at least not in the last year), drinks heavily, is addicted to drugs or lives an unhealthy lifestyle, your insurance policy premiums will be lower. Why? Statistically, each of the preceding traits indicates you are more likely to overlive your policy than to die before the term expires. Canadian insurance companies offer low rates to customers who are in good health because they take on less risk.

What affects the cost of insurance?

Your health and age affect the basic cost of term life insurance. You should lock into term life insurance as soon as you are in good health and can pass your medical examination. In addition, many term policies offer level premiums, which means you’ll pay the same amount regardless of your health as you age.

You can save thousands of dollars and avoid being considered uninsurable over the course of several decades. In the event you wait until you’re older or choose a shorter term that requires regular renewals, you’ll have to pay higher premiums.

What happens to term life insurance when it expires? Can I renew a term life insurance policy?

You can renew most term life insurance policies upon expiration without having to re-qualify medically.

Your premiums will increase as your age increases when you renew your policy. The majority of renewable term life insurance policies are upfront about this, guaranteeing the renewal premium amounts at the time of purchase. Many term policies offer a convertibility clause, which lets you convert your coverage into lifetime coverage rather than requiring you to renew it periodically.

Although you must lock in these clauses at the time of your policy purchase, they offer considerable flexibility by allowing you to begin with a shorter coverage period and increase it as your insurance requirements and finances evolve, without worrying about your health deteriorating.

Can I pick the longest term life insurance available?

You can definitely buy lifetime coverage, but it won’t be cheap and you may not need it.

Let’s look at an example.

Meet Joshua. He’s a 45-year old man, with two kids, John and Andrew. John is 10 and Andrew is 8. Life expectancy for a Canadian male is around 80 years so chances are he’ll die in the next 40 years. So, he should get a 40-year term policy to guarantee a payout, right? Well, not so fast.

Within the next 20 years, Joshua’s children will be financially independent adults. His partner is only 30 and will still be working at 50. When the kids move out, the cost of living will drop and it will become easier to make ends meet.

By choosing a 20-year renewable term policy with the same payout to cover his family’s financial needs, Joshua’s premium would be significantly lower than a 40-year policy. If he dies at 48 his family will receive the same amount of money in either policy, but he will have saved thousands of dollars while still living and will still be covered.

Conversely, if he’s still alive and kicking at 65, he can choose to extend his coverage for another 20 years, albeit at a higher premium, or reduce it entirely to match his new financial situation.

Can I get permanent life insurance coverage for my entire life?

A permanent life insurance policy in Canada pays a lump sum to your beneficiary when you pass away, regardless of your age. Premiums for permanent life insurance usually remain the same throughout your life and you never have to renew or convert your policy.

What is the average cost of permanent life insurance?

The cost of permanent life insurance is very high. The premiums are usually five to ten times higher than what you’d pay for a term life insurance policy with the same coverage amount. Because permanent policies are so complex, they’re priced this way.

Their value makes them appealing as investments and tax shelters. Sadly, for many people, a lifetime of expensive premiums can be too much of a drain on their bank accounts.

What are the different types of permanent life insurance?

In Canada, there are four types of permanent life insurance: Whole Life, Limited-Pay Whole Life, Universal Life, and Term to 100. Find out more about these policies below.

Whole life insurance and how it works

Your policy covers you until you are cremated (or buried, or cryogenically frozen, etc.) and has a cash value. The cash value of whole life policies accumulates over time at a guaranteed rate similar to that of a high-interest savings account or GIC.

You won’t have any say in how your insurer invests your premiums in a low-risk portfolio, so your insurer will pay you these rates out of the accrued cash value. It is possible for whole life policies to also pay dividends based on the profits of the insurance company. This is called participating insurance. If you choose a non-participating policy, you will not receive dividends.

It is also possible to surrender a whole life policy for its cash value or take a loan against it at some point. However, doing so will incur taxes or interest charges or both.

Limited-pay whole life insurance and how it works

Essentially, this is the same as whole life insurance, except a payment period is specified. For instance, the term could be 20 years. As long as you pay your premiums over that period of time, your insurance is guaranteed for life and you won’t have to worry about fees. Due to the fact that the premiums are front-loaded, this is typically the most expensive policy option. In addition, accelerated payments increase cash value more rapidly.

Universal life insurance and how it works

Universal life insurance is the same as whole life insurance, but it also includes self-directed investments. Depending on your policy, you are able to invest the cash value however you wish.

In exchange, you’ll need to actively monitor your investments with a universal insurance policy. It’s similar to building your own investment portfolio instead of investing in a mutual fund.

Term to 100 life insurance and how it works

Even though this policy has the term in the title, it is still a whole life policy that covers you until death. Unlike most traditional policies, however, this one does not have cash value or an investment component, so the premiums are a bit lower.

Furthermore, if you manage to reach the century mark and join the other 6,000 centenarians in the country, you’ll no longer have to pay premiums and you will still be covered. Because of this, Term to 100 insurance policies are uniquely Canadian.

Do I need whole life insurance coverage?

Permanent life insurance policies offer cash value and tax-free investment and payout opportunities. The policies can be very useful for wealthy people who want to use them for estate planning and to protect their savings. When they die, they can transfer more wealth to their families by offsetting their estate liabilities by contributing to their insurance policies until they drop into a lower tax bracket.

Regular income earners can also benefit from them. You can use whole life insurance to cover the costs associated with death that cannot be avoided, such as funeral expenses. As people age and their term life insurance comes to an end, they typically convert into permanent life insurance.

It’s important to note that 40 percent of permanent life insurance policies lapse within the first ten years. Some policyholders cannot afford the high annual premiums; you should choose coverage you can afford.

How can I lower the cost of life insurance premiums?

In order to reduce the premium cost of insurance, you should lower the death benefit amount. It’s also worth noting that comparable term life insurance will always be cheaper than permanent life insurance, and shorter terms will offer lower rates.

By sharing more personal information with your insurer that shows proof of good health, you can sometimes get further discounts.

What personal information do I need to share with my insurance company?

All insurance companies ask the same set of questions in most policies. You will also need to provide details regarding where you live, your age, and whether you smoke.

Based on your answers to these questions, you’ll be placed into a risk category and offered premiums based on your health, your family’s medical history, how much you drink, your history with drugs, and your passion for extreme sports (seriously).

The insurance companies hope that you won’t die while you’re covered (how sweet!) so they want to make sure you’re healthy before insuring you. When you show them you have a good health status, they will lower your rates. In-person medical exams are common with larger coverage amounts, and some insurance companies even provide free fitness trackers to track your activity levels while you apply for coverage.

A few basic insurance coverage plans are also available, that don’t require any deep examination and guarantee approval despite your health. They are usually called non-medical life insurance policies and are also known as guaranteed issue policies. They are, however, much more expensive and therefore not recommended for most people, especially if you’re in good health now.

Which is the best life insurance policy for me?

The answer to this question isn’t found in the back of the book. Life insurance is a deeply personal purchase and there are many factors to consider. In addition to taking into account your current family’s financial needs, you should also account for future expenses like tuition, funeral arrangements, estate taxes, and any other debts you would like settled if you died. (If that sounds complicated, there are insurance calculators). When you search for insurance quotes, there are a multitude of options to choose from. Nevertheless, you should only purchase a policy you can afford and that makes sense for you and your family.

Thankfully, AG Group Enterprise Ltd, is here to help! Our mission at AG Group is to provide a wide range of life insurance policies, including term coverage, permanent coverage, RRSPs, RESPs, and more!

With AG group’s insurance policies, you can protect the future of your family and your finances. A good policy ensures a bright future!