Accidents can’t be avoided. A disability can bring financial issues in addition to pain and severe physical or mental restrictions. This is because your ability to earn an income may be impaired.

Here are a few grim figures:

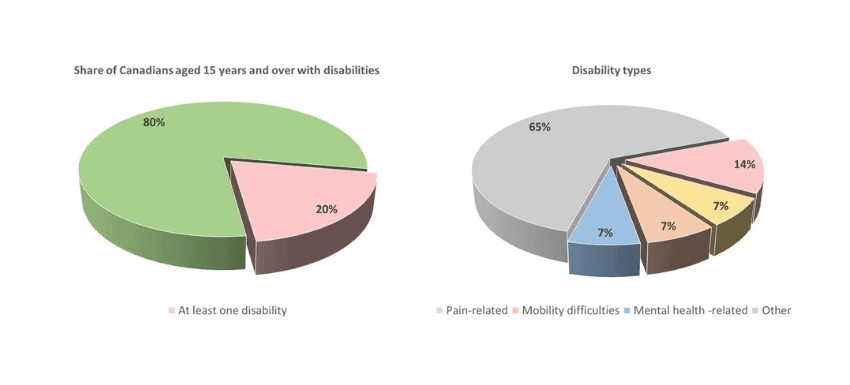

- According to Statistics Canada, 20% of Canadians aged 15 years and over (1 out of 5 or 6.2 million) had at least one disability in 2017.

- At least 24% of female Canadians and 20% of male Canadians have at least one disability.

- In terms of disability type, 14% are pain-related, 7% relate to flexibility issues, 7% are mobility difficulties, and 7% are mental health-related.

Fortunately, there are insurance policies available to safeguard you. You may or may not be aware of all of them. Some are provided as part of a job, while others can be acquired separately, and some are provided automatically by your federal and provincial governments.

Disability is a complicated topic to discuss, despite the fact that it is becoming increasingly popular. We decided it was time to put together a comprehensive post that covers everything you need to know about the handicap system because a proper explanation can be difficult to come across.

What is disability insurance?

Disability insurance, in general, is a sort of insurance that protects you financially if you become disabled and unable to work. In this situation, a disability insurance in Canada would help cover your lost income until your health improves or your policy term expires. Depending on the severity of the disability, many disability insurance claims might endure for years or even into retirement.

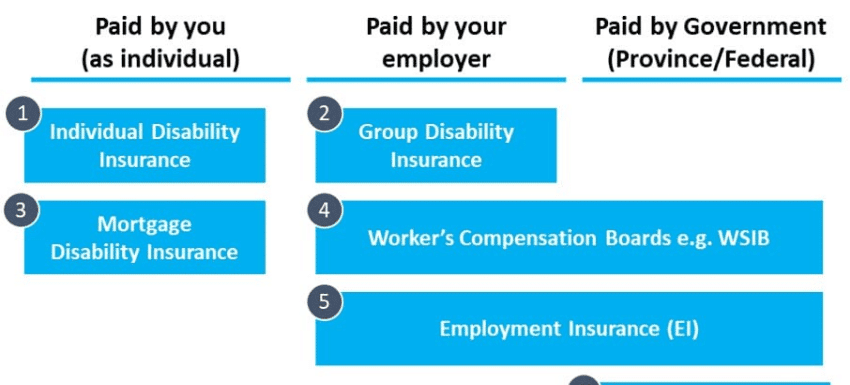

It’s important to remember that disability insurance in Canada isn’t one-size-fits-all, and there are various types of disability insurance.

- Individual disability insurance

- Group disability insurance

- Mortgage disability insurance

- WSIB disability insurance (Workplace Safety and Insurance Board)

- EI sickness benefits (Employment Insurance)

- Canada Pension Plan disability protection / Quebec Pension Plan (QPP) disability protection

- Provincial disability plans (such as e.g. ODSP – Ontario Disability Support Program)

It’s important to recognize that not all disability insurance types apply to all situations – remember, this is not a one-size fits all situation, but we will explain each of the insurance types below.

Who needs disability Insurance?

You should get disability insurance in Canada if you work and earn money (either as an employee or as a self-employed person). Many Canadians do not have sufficient funds to support themselves if they are unexpectedly unable to work.

What Disability insurance Covers?

Different accident situations are covered by different types of accident or disability insurances:

- Work-related accidents and injuries: Some types of protection e.g. WSIB insurance would cover work-related accidents/injuries

- Accidents / injuries during work and in off-work time: Some types of insurance e.g. disability insurance from private or group insurers would cover accidents/injuries that occurred both during work and in off-work time).

The primary function of any of these insurance products, however, is to replace or supplement a loss in income.

How much disability insurance do I need?

You should examine your insurance requirements in the same way that an insurer would. What is your current salary? On a monthly basis, how much do you spend? This is an excellent place to begin. Your disability compensation will be linked to the income you were making previous to the accident.

It’s not as simple as having your full pay replaced by disability insurance. When it comes to disability insurance benefit payouts, there are four crucial numbers to consider:

- Benefits as a percentage of income: It might be anything between 50% and 85% of your present earnings. Be aware that many disability benefits are typically capped at 85 percent of gross income.

- Benefits cap: This is the maximum amount of benefits you can receive. If you earn $10,000 per month, an insurance company may limit your benefits at $6,000 per month. The benefit is tax-free for most plans where you pay the premium.

- Benefits length: This is how long your benefits will be paid. It’s usually until you’re able to return to work or until you reach a certain age (e.g. 65 years old, when you can apply for retirement benefits).

- Waiting period: In most circumstances, benefits payments do not begin right away, but rather after a certain amount of time, known as a waiting period. It can be as little as a few days in some cases (e.g., for short-term impairment), but it can also be much longer in others. 90 days is a common option, so see whether you have enough money set aside to handle the months before you get your first paycheck.

What kind of disability insurance plans are there?

As indicated in the diagram below, there are various options. Keep in mind that not all of these can protect you at the same time — they are situation-specific.

What is individual disability insurance?

Individual disability insurance is obtained when you seek coverage from an insurance company or broker on your own, in addition to what you may already have through your workplace or provincial benefits. Many people choose this option if they are self-employed and have no employment benefits, if they work for a small business that provides some but not complete benefits, or if their employer does not provide the full disability insurance coverage possible.

For example:

Fred’s work offers a competitive benefits package, but he is afraid that his disability insurance will only replace half of the income he loses due to a disability. To be safe, Fred schedules a meeting with an insurance broker to obtain supplementary disability insurance in Canada to supplement his current policy.

Group disability insurance explained

As an example, Fred’s workplace provides him with group disability insurance as a condition of employment. Life insurance and group health insurance are frequently combined to provide this protection. You should be aware of the extent of this insurance’s coverage and the fact that it is only effective while you are employed by the company. When you leave the employer, your coverage ceases, and it is rarely transferable.

If you are able to undertake ANY profession, your group disability benefits will most likely stop after 24 months. These plans may also include a cap (known as the “no evidence maximum”) on the amount you can receive. In some circumstances, in order to go a certain way, it’s necessary to take a certain route.

How does mortgage disability insurance work?

Mortgage disability insurance only covers missed mortgage payments if you are unable to make them due to a temporary or permanent disability caused by an accident or injury.

This coverage is primarily sold by banks, but it is also accessible through independent insurers. This is a sensitive topic among insurance carriers because a comprehensive disability insurance plan will cover all of your expenses, not just one. If you have your own disability insurance and also pay for mortgage disability insurance, talk to your insurer about whether your mortgage disability coverage is redundant.

The availability of mortgage disability insurance is likewise limited. Make sure you read the fine print. It’s possible that it will only cover your bills for a limited time, regardless of whether you remain incapacitated. If this is the case, you should look into purchasing an individual disability policy if you don’t already have one.

What are WSIB and WCB?

Workspace Safety and Insurance Board (WCB-Alberta in Alberta, WorkSafeBC in British Columbia, and so on) is a protection that covers accidents and injuries that happen at work. It does not cover you for injuries that occur outside of work.

Because not all employers offer WSIB coverage (or other Worker’s Compensation Boards in other provinces), it’s crucial to understand what yours does. WSIB coverage is required in some areas, such as construction, but not in others, such as banks, travel agencies, computer software developers, trade unions, and so on. It’s also worth noting that many small businesses and start-ups will be excluded from this coverage.

Because it is a “no-fault” insurance, WSIB coverage precludes employees from suing their employers.

What is EI?

EI (employment insurance) is a program that helps people who have lost their jobs or are unable to work due to no fault of their own. To be eligible for this assistance, the person must have been fired rather than quit on their own. Although there are exceptions, most people pay into EI every pay cycle, as you can see on your pay statement. If you pay into EI, you are eligible for this benefit if you meet all of the other requirements.

Sickness benefits from EI (employment insurance) can be granted to persons who are unable to work due to health-related issues such as illness, injury, or quarantine. The maximum amount of coverage for EI sick

Canada Protection Plan disability insurance explained

The Canada Protection Plan is a Canadian Pension Plan disability pension paid to those who contributed into the Canada Protection Plan during their work. Similar to EI, these benefits are usually withdrawn automatically from your wage/salary (employment insurance). It’s the same with the QPP (Quebec Pension Plan) (Quebec residents or workers).

There are a few more advantages in addition to the Canada Protection Plan disability pension, such as:

Children’s advantage: If you have dependent children and already receive a Canada Protection Plan disability pension, you may be eligible for this.

Canada Protection Plan post-retirement disability benefits: If you are no longer eligible for a disability pension because you were getting it for longer than 15 months, this benefit could be an option for you.

How much does Canada Protection Plan disability pay?

For 2021, the average Canada Protection Plan disability monthly payment is $1,001.15 and the maximum payment anyone can get is $1,362.30.

The total amount you receive is calculated as $496.36 + an additional benefit (retirement income x .75) that is based on how much you’ve contributed to Canada Protection Plan throughout your career.

What is ODSP?

If you live in Ontario and have a disability, the Ontario Disability Support Program may be able to assist you with your living expenses (ODSP).

The ODSP provides financial support as well as benefits to you and your family, such as prescription medications and vision care. Furthermore, the curriculum might assist you in finding and keeping a job, as well as growing your career. In other words, there are two forms of assistance available: income assistance and employment assistance. Note that each type of ODSP assistance has different qualifying requirements, so you should check the provincial government’s website for the most up-to-date information.

Do disability plans stack?

While there are many distinct types of disability payments available in Canada, most of them CANNOT be combined (stacked) or collected in full at the same time in order to prevent fraud.

This is known as “benefit integration,” and it sets a limit on the total amount of money that can be earned from all sources. Your benefits are also situational, so your work type, employer coverage, and other factors will all influence the types and amounts of benefits you are eligible for.

How much disability insurance can I get?

The maximum is 85% of pre-disability earnings. It would be too tempting for people to file false claims — in other words, commit fraud – if they could replace 100% of their lost income. It’s common for disability compensation to range between 40% and 85% of your pre-disability earnings. Please keep in mind that if you receive disability benefits from various sources (e.g., WSIB, individual disability insurance, etc. ), one or more of these insurance benefits will reduce your payout to ensure you don’t earn more than the authorized proportion of your pre-disability gross income.

Final Word

This general summary should have been useful to you. While disability insurance in Canada is complicated and frequently misunderstood by internet resources, keep in mind that there are experienced disability insurance specialists that can assist you figure out what coverage is available to you and what you require the most.

Which is the best life insurance policy for me?

The answer to this question isn’t found in the back of the book. Life insurance is a deeply personal purchase and there are many factors to consider. In addition to considering your current family’s financial needs, you should also account for future expenses like tuition, funeral arrangements, estate taxes, and any other debts you would like settled if you died. (If that sounds complicated, there are insurance calculators). When you search for insurance quotes, there are a multitude of options to choose from. Nevertheless, you should only purchase a policy you can afford, which makes sense for you and your family.

Thankfully, AG Group Enterprise Ltd, is here to help! Our mission at AG Group is to provide a wide range of life insurance policies, including term coverage, permanent coverage, RRSPs, RESPs, and more!

With AG group’s insurance policies, you can protect the future of your family and your finances. A good policy ensures a bright future!