If you die from a natural cause, an accident, suicide, or murder, life insurance payout to your beneficiaries. In some cases, such as those involving fraud or crime, the insurer may refuse to pay the death benefit.

Your beneficiaries have complete discretion over how they utilize the death benefit once it has been issued by the insurer. They can use the money from the life insurance payout to pay for items like funerals, bills, and day-to-day needs.

Continue reading to learn about what life insurance premiums are, benefits of life insurance, as well as what it covers.

What is Life Insurance Premium?

The term “insurance premium” refers to a certain sum that the insured person must pay on a regular basis to keep their insurance coverage, as determined by the insurance company.

An insurance company considers the type of coverage chosen, the policyholder’s lifestyle and health circumstances, and the possibility of a claim, among other things, when determining the premium amount.

Companies hire actuaries to provide precise study of a person’s life and insurance premium computation. They are in charge of assessing the risks involved with a certain occurrence or claim, and the bigger the risk, the higher the insurance premium.

How to Pay Life Insurance Premiums?

When it comes to paying the premiums on your life insurance policy, you have a few alternatives. In most cases, policyholders can pay their insurance premiums in monthly, quarterly, half-yearly, or annual payments. The Premium Payment Mode refers to the frequency with which premium payments are made.

Then there’s the Premium Payment Term, which specifies how long the premium must be paid, or how many installments it must be paid in.

What Happens if you Fail to Pay Life Insurance Premiums?

The life insurance policy enters a grace period when the policyholder fails to pay a premium by the due date. The grace period is the additional time offered to you after a missed premium payment before your coverage lapses.

The life insurance policy will lapse if no payment is paid within the grace period, and the policy benefits would be terminated.

As a result, term life insurance payments must be paid on time or the policy may lapse.

What does a Life Insurance Company do with the Premiums?

A life insurance company can use the premiums you pay for your policy in a variety of ways. Some of your life insurance premium goes into day-to-day business operations, while others go toward paying the death claims of other policyholders’ beneficiaries.

To earn profits, a portion of your life insurance premium is invested in various government bonds and investment schemes.

What Factors Impact the Life Insurance Premiums?

If you’re seeking to get a life insurance policy, you might be wondering what factors would influence your insurance rate. The earlier you purchase a life insurance policy, the lower your premiums will be. You may also be provided a longer period of coverage and better benefits.

Lifestyle – Certain lifestyle behaviors, such as smoking and drinking, have been associated to an increased risk of sickness, which may necessitate the payment of higher life insurance premiums. As a result, adopting a healthier lifestyle may not only keep you safe in the long run, but it may also help you acquire better insurance rates.

The premium amount is determined by the insurance term and the sum assured you select when purchasing a policy. This should not, however, prevent you from selecting an appropriate amount to be given to your family while you are away.

Similarly, the policy’s term must be determined by your budget and skills.

It is generally advisable to have a thorough understanding of your premium payments and why they are the size they are.

What does life insurance cover?

Life insurance coverage provides a long-term safety net. Its goal is to make your dependents’ lives easier after you are no longer able to support them. The proceeds from a life insurance policy can aid your family in a variety of ways. Funeral costs, outstanding bills, education fees, and other expenses may be covered by the settlement.

What expenses are covered by life insurance?

Your family can spend the money however they like. It can be used for a variety of purposes, including:

Monthly bills and expenses

Whether or not you are the primary breadwinner in your family, you most likely contribute to the cost of living such as rent, groceries, childcare, and so on. As a result, it is advised that you purchase a coverage that is at least ten times your yearly income.

Outstanding debts

Debts, such as a mortgage, do not just vanish when you die. It’s possible that your loved ones will be responsible for repaying these debts after you pass away. If you don’t want this to happen to you, consider purchasing life insurance.

Child or dependent care

All childcare expenses, whether you do it yourself or pay for it, can be covered by life insurance.

End-of-life expenses

In Canada, a burial can cost anywhere from $5,000 to $10,000. Consider purchasing life insurance if you do not want to leave a financial burden on your loved ones after you pass away. A life insurance policy can pay for all of your final expenses, such as medical care and funeral costs.

College costs

In the event of your death, the funds may be used to assist your family with educational expenses.

What types of death are covered by life insurance?

What is covered by life insurance? Is natural death covered by life insurance?

This section answers all inquiries about the types of deaths that are covered by basic life insurance.

Except for a few exceptions, life insurance covers all deaths. If your policy was active at the time of your death, the insurer will pay claims for the following reasons:

- Natural causes – For instance, death due to stroke, cancer, or old age.

- Accidental death – This includes death due to accidental drug overdose.

- Suicide –Suicide is only covered by life insurance policies if it occurs after the first two years of coverage.

- Homicide – Your insurance will pay the death benefit if your death was judged a homicide and your beneficiaries were not implicated.

- Pandemic-related illness – Your family will get the reimbursement if you die from a pandemic-related sickness, such as coronavirus, while your coverage is still active.

What does life insurance not cover?

Life insurance does not cover the following items.

- Expired policies –Only if you die during the policy term or while the policy is active will the death benefit be paid out. Term life insurance covers you for a set amount of time. As a result, if you buy a 20-year term policy and die before it expires, the insurer will not pay out. Your beneficiaries will not get the death benefit if you let your term life or permanent life policy lapse owing to non-payment and die while the policy is inactive.

- Fraud – A contestability period of usually two years is included in most life insurance plans. The insurer has the right to investigate your death if you die during this time. If your insurance company discovers that you lied on your coverage application, they have the right to withhold payment. As a result, make sure that all of the information you include in your application is correct..

- Criminal activity – The insurer will not pay out if you die while engaging in criminal conduct. For example, if you die in a car accident while driving while inebriated, your insurer may refuse to pay your claim.

- Exclusions – Some exclusions may be included in some life insurance contracts. If there are any exclusions, they will be noted in your insurance. It’s critical that you read and comprehend them; otherwise, your loved ones may be left without compensation.

The aviation exclusion, which only applies to private aircraft, is one of the most popular exclusions. Insurance companies usually do not pay out the death benefit if the policyholder dies in a private jet crash. If you were traveling on a public plane, however, most (if not all) insurance companies will pay out.

What life insurance might — or might not — cover

Death by Risky Hobby

Are you a bungee jumper? Do you enjoy scuba diving? Is it your dream to fly private planes? While these pastimes are thrilling and daring, insurance companies are not fond of them. Such pastimes raise your chances of dying in an accident, raising your life insurance premiums.

Companies that provide life insurance must make a profit. Given this, it’s only reasonable that they’d seek to minimize their risks.

As a result, your policy may state that if you die while participating in a dangerous activity, such as bungee jumping, the insurer will not pay your family a death benefit. However, you will most likely be able to obtain coverage. However, to compensate for the increased risk, the insurer will charge you a higher rate.

Just ensure you inquire about what is included in your policy and what is not. You do not want to pay thousands of dollars in premiums, only for your loved ones to find out that your policy did not cover your hobbies at all.

Death by Suicide

Unless the death happens during the first two years of the insurance, life insurers pay out the death benefit in the event of suicide. Suicide classes are included in life insurance contracts, and they prevent beneficiaries from collecting the proceeds if the insured dies within a particular time frame — usually two years — after purchasing the policy.

There’s a reason why the suicide clause exists. Its goal is to dissuade those who plan to commit suicide from purchasing a policy at the last minute in order for their loved ones to collect the death benefit.

Medical Expenses While You are Alive

Under certain circumstances, an expedited benefits rider allows you to access the death benefit while you are still alive. If you meet certain qualifications, the insurer will normally pay a portion of the death benefit – usually 50%.

You may be entitled to use the death benefit to pay for medical care if you become terminally ill and have a life expectancy of fewer than 12 months. Similarly, someone suffering from a chronic illness may be eligible for living benefits.

An expedited benefits rider has a handful of downsides while being a valuable add-on. To begin with, this is a paid rider. That implies that if you choose it, your insurance premiums will rise. Two, if you use your death benefit, there will be less money left over for your loved ones after you pass away.

Consider the case of Susan, who has a $1 million life insurance policy. Susan has just been diagnosed with Stage 3 Pancreatic Cancer and has an estimated life expectancy of about 11 months.

She withdraws $400,000 from her insurance coverage to pay for her therapies. Her spouse will inherit the remaining $600,000 when she dies.

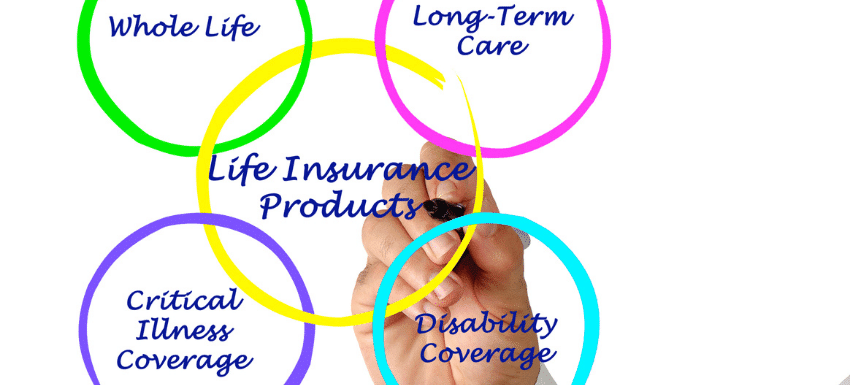

Long-Term Care

A long-term care (LTC) rider is a paid addition to your life insurance policy that allows you to receive a portion of your death benefit while you are still alive. You can use the money to pay for long-term care. Nursing homes, injury rehab clinics, in-home services, and assisted living facilities are all examples of long-term care.

With permanent life insurance plans, the LTC rider is usually available. Insurance companies that are willing to provide living benefits for term life insurance plans are harder to come by.

Naturally, if you take advantage of the death benefit while you are still alive, your beneficiaries will receive less once you pass away.

How quickly does a life insurance policy payout?

The reimbursement is usually received within a few days, but it can take up to a month for the check to arrive. The speed with which you receive the funds is determined by a number of factors. The procedures of the insurance company and whether the policy is in the contestability period are two examples.

The contestability period usually lasts two years after your policy takes effect. If you die within this time, the insurance may investigate your death, which may cause the payout to be delayed.

When a claim is made after the two-year period has passed, carriers typically handle it swiftly – usually within 15 days. Because insurers risk severe fines if they delay claims unduly, they often want to expedite the process.

Delays are frequently caused by incorrect documentation and inadequate information. To verify that everything is in order, double-check the claim form before submitting it.

Conclusion

Life insurance will not be able to replace you, but it will be able to cover a portion or all of your income if you die. The funds will be used to support your dependents while you are away.

They can use it to pay off their mortgage, cover day-to-day living expenses, and put money towards their children’s school. You can acquire a life insurance policy that is suited for your needs at an affordable rate by dealing with an independent broker.

Which is the best life insurance policy?

The answer to this question isn’t found in the back of the book. Life insurance is a deeply personal purchase and there are many factors to consider.

In addition to taking into account your current family’s financial needs, you should also account for future expenses like tuition, funeral arrangements, estate taxes, and any other debts you would like settled if you died. (If that sounds complicated, there are insurance calculators).

When you search for insurance quotes, there are a multitude of options to choose from. Nevertheless, you should only purchase a policy you can afford and that makes sense for you and your family.

Thankfully, AG Group Enterprise Ltd is here to help! Our mission at AG Group is to provide a wide range of life insurance policies, including term coverage, permanent coverage, RRSPs, RESPs, and more!

With AG group’s insurance policies, you can protect the future of your family and your finances. A good policy ensures a bright future!